Mastercard Expansion Program for Cryptocurrency Wallets and Exchanges

Spending Your Digital Assets

You have invested in cryptocurrency. Now, how do you spend it?

An asset you can’t spend without converting it into money is hard, not liquid. more like a car than like cash.

But crypto is meant to be the digital equal of precious metals. So it ought to be a simple matter to turn it into liquid assets—money that you can use in everyday transactions.

Barriers to Entry

The most basic question to ask about any new medium of exchange is who will accept it. This determines its usefulness in the economy. Some people are reluctant to invest in these digital, decentralized currencies. They don't know what banks and businesses will accept crypto. So investing in crypto doesn't seem appealing to them.

Unfortunately, not all cryptocurrencies have the technological resources for conversion into dollars. This makes it difficult for you to spend your digital assets. But, as banks and companies within the Mastercard network. Have noticed the rising interest in crypto. And have asked Mastercard for support to keep customers. That might otherwise turn to crypto exchanges.

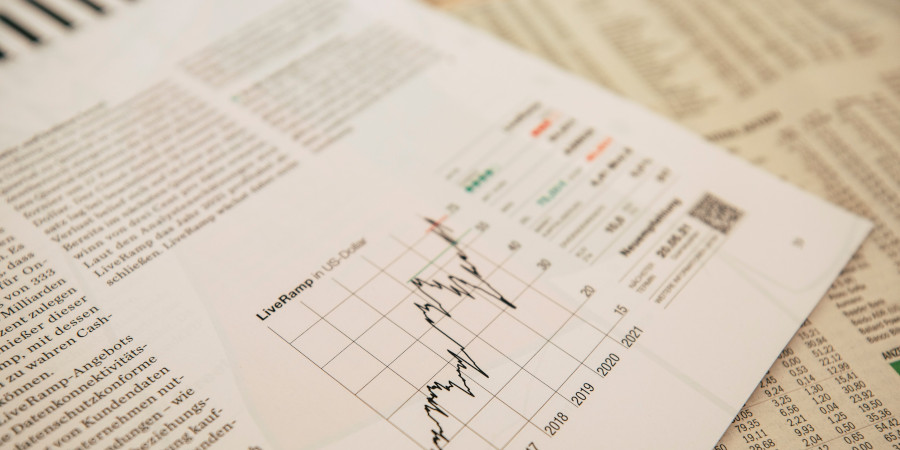

In February of 2021. Mastercard announced an enhanced program to address both of these problems. This program will give these cryptocurrencies. And company's, technology to lift some of these barriers to entry. What if the cryptocurrency you use offers a Mastercard option? Mastercard’s partners will be able to convert your digital assets into dollars. Much more easily than they could before.

Mastercard is partnering with the digital assets community. This includes companies that use Stablecoins. To perform conversions of cryptocurrency to traditional money.

Using Stablecoin to Convert Cryptocurrency to Traditional

Stablecoin is crypto tied to real-world assets. These assets include traditional fiat currency (e.g. the US dollar) or precious metals.

As the name suggests, Stablecoin is less subject to fluctuations in value. Other cryptocurrencies derive their value from peer-to-peer cryptographic technology. As well as from market trends resulting from other investors’ decisions. The value of Stablecoin, so, depends on the value of the traditional currency.

Thus, Stablecoin has both the price stability of fiat currency. And the advantages of crypto. These advantages include security, mobility, and privacy. Because of their price stability, Stablecoins are closer to liquid assets. Then closer to hard assets.

Some examples of Stablecoins are Dai, USDC, and Binance.

As of September 2021, Mastercard is using USDC for its conversions. USDC is a Stablecoin that almost always trades at $1. You pay in crypto, Mastercard swaps it for USDC. The USDC is converted to dollars. And the company you are doing business with receives fiat currency.

Using Stablecoins as a middleman. For the conversion of crypto to cash might sound like an extra step. In fact, it actually makes the process smoother and more reliable.

A Stablecoin works a bit like an IOU. You use fiat currency to buy Stablecoins that you can redeem later. And you will redeem them later for the same amount of money you originally paid. No interest in either direction. If the asset backing a particular Stablecoin is gold, that Stablecoin is a digital IOU for gold.

Partners in the Mastercard Network

Some of Mastercard’s partners in the financial technology (fintech) industry include:

For issuing cards:

- Evolve Bank & Trust, a technology-focused financial service provider

- Metropolitan Commercial Bank, a full-service entrepreneurial bank

As providers of bitcoin wallet technology:

- Uphold, a multi-asset digital money platform

- BitPay, a bitcoin and altcoin payment service provider

For processing and program management:

- Galileo Financial Technologies, LLC, a digital banking platform

- Apto Payments, a card issuance platform

- i2c Inc., a digital card issuing and payment processing platform

For conversion to fiat currency through Stablecoins:

- Circle, a blockchain technology platform

- Paxos Trust Company, a financial institution and blockchain technology company

Benefits for Merchants and Financial Institutions

Thanks to this enhanced program. You will be able to spend your digital assets wherever Mastercard is accepted. A sign reading “We accept Mastercard” will be as good as one reading “We accept cryptocurrency.”

This program will benefit millions of clients on the Mastercard network, including:

Banks, now able to offer:

- Bitcoin wallets to secure your crypto

- Credit and debit cards that offer opportunities to earn and spend bitcoin

Merchants with rewards Programs:

- Hotel points convertible into bitcoin will be effectively as good as dollars

- Businesses, like restaurants, have traditionally offered points to customers. But now will be able to offer rewards in the form of cryptocurrency.

Mastercard is one of several financial institutions expanding to include these cryptocurrencies. Which are new mediums of digital exchange for these institutions. Cryptocurrencies have been waiting for this kind of infrastructure to increase their usefulness. And greater usefulness will earn them respect.